Greenbuild is the world’s largest conference and expo dedicated to green building. The ideals and passion of the green building community come alive at Greenbuild. The buzz is contagious. Greenbuild brings together industry leaders, experts and frontline professionals dedicated to sustainable building in their everyday work, and a unique energy is sparked. Participants are invigorated. Inspired. They find themselves equipped to return to their jobs with a renewed passion and purpose.

Join with GRESB for the following events:

Education Session: GRESB – The Investor Perspective

Event Description

This session provides an introduction to GRESB Real Estate in order to gain a broader understanding of the GRESB Assessment and Portal.

The session will look at ESG data for real estate portfolios and explore why investors are calling for this information and how they, property managers, and other professionals in the real estate sector can use it in relation to their real estate portfolios and to inform their sustainability strategies. The session will also look specifically at how GRESB Investors are currently using the GRESB results, and share case studies from them.

In addition to the GRESB Benchmark report that participants and investors can see for submissions, members can make use of the GRESB Portfolio Analysis Tool to create customized reports. The analytical tools in the GRESB Portal will be explained in depth so that users can learn how to more fully leverage the insights available from their GRESB data.

Learning Objectives

- Learn basics of GRESB

- Learn what kind of data is available in the GRESB Portal and how to use the analytical tools

- Learn why investors are calling for ESG data and why it is important to their decisions

- Practical application: How to use the GRESB Portfolio Analysis Tool

Presenters

Roxana Isaiu Director, ESG & Real Estate, GRESB

Ulrich Scharf, Director of IT & Analytics, GRESB

Logistics

| Date | Monday, November 6 |

| Time | 8:30 am to 12:30 pm |

| Location | |

| Registration | Greenbuild website |

Breakfast Session: PACE Financing: Strategic Opportunity, Tactical Benefits and Practical Implementation

Presentation on SlideShare

Event Description

Property Assessed Clean Energy (PACE) is an innovative financing program growing across the country. To date, 34 states and DC have enacted PACE enabling legislation and 19 states have active commercial PACE program(s). PACE permits commercial properties to obtain long-term, fixed interest rate financing for the installation of energy efficient, renewable energy and water conservation measures. PACE financing is repaid through a special assessment as part of the property tax collection process.

PACE is particularly attractive for commercial property owners for a number of reasons, including (i) extended term – up to 20 years; (ii) transfers with the sale of the property to new owner, who continues to benefit from the energy savings; (iii) off-balance sheet financing; and (iv) in certain leases structures, tenant pays the increased property taxes which are offset by tenant’s reduced utility and operation costs.

This session will outline the potential opportunities REITs can realize by utilizing PACE in eligible markets. Such benefits include:

- 100% financing for capital-intensive improvements with no personal guarantees

- Lower energy costs resulting in cash flow positive projects

- Owner retains all tax and utility incentives

- Improve asset value and accelerate sustainability goals

Learning Objectives

- Understand opportunities to use PACE financing for capital improvement projects

- Identify the range of opportunities to realize operating expense savings to finance PACE borrowing obligations

- Acquire expert insight into specific lease clauses and other decision drivers

- Recognize how PACE is a valuable tool to increasing short-term income and overall asset value

Moderator

Dan Winters, Head of Americas, GRESB

Speakers

Brian McCarter, CEO, Sustainable Real Estate Solutions, Inc

Keirstin Beck, Principal, Integro, LLC

Kevin McSweeney, Regional Sales Manager, EnerNOC

Sponsor

Logistics

| Date | Tuesday, November 7 |

| Time | 7:30 am to 8:45 am |

| Location | Convention & Exhibition Center, Rm 256 |

| Registration | GRESB registration |

Breakfast Session: Sustainable Investment Strategies – ESG as Value Driver

Event Description

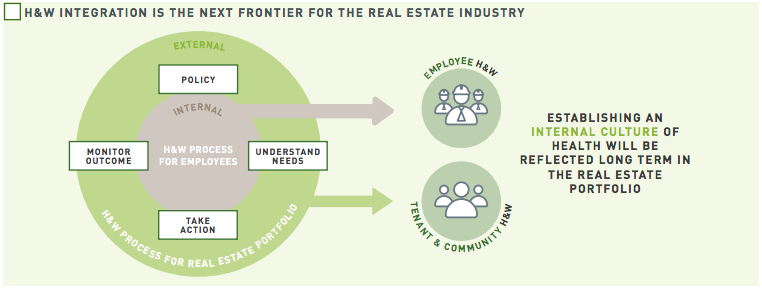

Smart, sustainable developments support the attraction and retention of talent required to maintain and grow a city’s economy. Sustainable urban neighborhoods continue to shift away from car-centric design emphasizing multimodal transportation access, an amenitized lifestyle, and reduced environmental impacts. This session explores

Learning Objectives

- Understand the importance GRESB plays to the engagement dynamic between investors and portfolio managers

- Identify areas where environmental and social aspects add to a real estate project’s overall viability, investor alignment, and long-term asset value.

- Acquire significant insights into downtown Boston’s largest transit-oriented development project, the 2.9 million of Bullfinch Crossing in the heart of Government Center

- Learn how private equity fund managers factor ESG measures into risk assessments and business decisions

Moderator

Dan Winters, Head of Americas, GRESB

Speakers

Tom O’Brien, Managing Director, HYM Investment Group

Josh Nothwang, Practice Leader, Sustainability and Energy, US Water and Environment, WSP | Parsons Brinckerhoff

Deborah Ng, CFA, Director Strategy & Risk, Head of Responsible Investing, Ontario Teachers’ Pension Plan

Tony Pringle, Partner, Quinn & Partners

Logistics

| Date | Tuesday, November 7 |

| Time | morning Breakout Panel |

| Location | Convention & Exhibition Center |

| Registration | Greenbuild website |

Logistics

| Date | Tuesday, November 7 |

| Time | 6:00 pm |

| Location | Row 34 | 383 Congress St. Boston, MA 02210 |