GRESB Green Bond Working Group, March 2016

The fourth meeting of the GRESB Green Bond Working Group addressed the constructs, protocols and benefits of a green bond roadshow. Speakers included Victoria Clarke from HSBC’s green bond investment banking group, Christophe Garot representing two-time green bond issuer Unibail-Rodamco and Viktor Stunnenberg who serves as Senior Portfolio Manager at the institutional investment arm of Achmea Investment Management. Each provided their unique experiences and perspectives on green bond issuer-investor best practices for effective underwriting and communication strategies.

Impacting the Learning Curve

Green bond roadshow dynamics aren’t widely discussed within industry circles. GRESB Green Bond Working Group members learned how effective roadshow communications can bridge issuer intentions with investor expectations. A primary reason for issuing a green bond is attracting and broadening a company’s bond investor base – setting upfront expectations and intentions is an important component to the successful underwriting and green bond placement process.

Several GRESB Members noted the learning curve experienced by first time issuers and/or investors requires additional upfront effort to identify and communicate targeted impacts and expected outcomes. Examples include ring-fenced investments in energy efficiency upgrades that can impact the bond’s overall risk profile and carbon footprint. Roadshows are used to narrow the knowledge gap between a sponsor’s intent and investor expectations, thus improving market understanding for the differentiation characteristics inherent to a green bond.

Besides market differentiation, green bond roadshows allow issuers and investors to engage pertinent business issues on deeper levels, going beyond the transaction-based nature of a traditional bond offering. By elevating discussions on energy and water consumption, stakeholder engagement dynamics, and asset-level investment opportunities, investors often gain a deeper understanding of the issuer’s underlying business dynamics, investment risk mitigation strategies and insights into management’s use of capital proceeds.

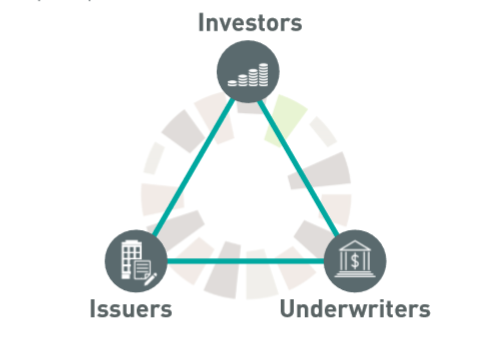

Working group members emphasized the important role underwriters play as they assist issuer’s efforts to identify and describe sought-after impacts, and work to guide investors on the targeted outcomes from the green bond. Underwriters recognize certain challenges arise when projecting investment impacts and outcomes in the face of ever-changing real estate market dynamics and tenant demands. Striking a balance between economic terms and sought-after ESG impacts is an important element in any green bond offering.

Investors bring a wide range of experiences and expectations to a green bond discussion. Breadth and scope of investor knowledge plays a crucial role in the roadshow process, and directly impacts investor questions and information requests. HSBC indicated that green bond meetings increasingly include the investment analysts focused on debt-oriented credit risk issues joined by ESG analysts who seek to understand the issuer’s overall ESG reputation and track record using sources like GRESB and related investment research analytics coupled with the specific objectives of the green bond offering.

Early green bond investors report basing their investment preferences on one or more specific impact issues including carbon emissions reduction, water conservation, ecology impacts, or other related concerns. As the green bond market advances, an increasing number of mainstream investors are seeking to keep pace. Expanded investor interest leads to investors taking a closer look at an issuer’s ESG profile and related data. Investors seek comprehensive ESG information about the issuer in an effort to evaluate both the framework underlying the green bond alongside the entity’s credibility and overall track record on sustainability-based aspects.

Investors typically seek alignment between overall sustainability goals and the underlying green bond framework. GRESB members surfaced a point of considerable industry discussion, specifically if a company should be required to have a high ESG score as a prerequisite for issuing a green bond. It was generally agreed that investors should provide latitude to entities financing credible forward-looking sustainability objectives with green bond offering. In instances where issuers lack an extensive ESG track record, issuers should describe the specific uses of bond proceeds and prepare to describe detailed plans to deepen engagement on ESG issues thus improving the firm’s baseline score.

Primary Road Show Benefits

There are two main benefits of a green bond roadshow:

- Enabling the issuer to better align financial strategy and ESG strategy thus positively impacting bond terms. [see GBWG Meeting #3]

- Forging deeper and stronger relations between the issuer and its investors.

Successful green Bond issuances require cross-departmental coordination to develop and articulate the investment strategy and use of proceeds. The investment strategy typically includes targeted operational impacts, financial outlook refinements, and associated risk adjustments. These financial projections are developed alongside the GRESB Green Bond Guidelines for the Real Estate Sector to project outcomes that reduce energy and water consumption, waste generation, and/or GHG emissions.

A competent green bond offering is the result of internal alignment. Management teams must work closely to develop and construct the sustainability-focused investment program, thus improving the overall business underpinnings within a range of executives and line personnel.

Experience shows that green bond roadshows deepen and strengthen relationships with investors. Beyond the base financial discussions, meetings typically expand the conversation to cover particulars of the overall green bond framework, investment strategy, implementation and sought-after outcomes. The result is enhanced opportunity for investor and issuer alignment regarding long-term goals and sustainability-based improvements affecting collateral risk and obsolescence.

Road Show Preparation

Call participants engaged in-depth discussion around how issuers should prepare for the roadshow. Main suggestions brought forward by experienced underwriters and issuers include:

Targeting: Decide early on which investors to pursue – green investors vs. non-green, those who have green bond fund vs. those who don’t, etc. when contemplating a strategy to broaden the investor base. Investors maintain a knowledge disparity on green bonds leading to a range of meeting dynamics.

Preparation: Sophisticated investors take a closer look at the green bond framework alongside the issuers overall sustainability credentials. Be prepared to address both use of proceeds questions and entity track record as these aspects are important to the credibility of the green bond offering.

Prioritization: Time efficiency is the key with underwriters connecting to the right people within the investor organization. The objective is to focus attention on investors most likely interested in the particulars underlying the green bond investment strategy, thus minimizing time invested in those who seek market education.

Underwriter Presence: Having a knowledgeable green bond underwriter at the issuer’s side during the roadshow is often helpful to answering detailed questions sure to arise regarding use of proceeds, implementation, and ongoing reporting of impacts and outcomes.

The fourth meeting of the GRESB Green Bond Working Group included a discussion on impact reporting. Several institutional investors voiced a continued desire for a comprehensive reporting framework that provides information on impacts and outcomes stemming from the use of proceeds [see GBWG Meeting #2].

Working group members acknowledged challenges faced by issuers who are developing new buildings, as it is difficult to provide specific projections and commitments to ESG-based outcomes during the roadshow. In these cases, future performance is subject to a wide array of unknown factors including tenant type, space use, energy intensity of the underling economic activity, and other related factors.

The meeting concluded with members agreeing that the green bond roadshow is more extensive than the usual credit-focused bond underwriting meeting, or ESG update discussion. Green bonds provide an opportunity to engage detailed discussion on the use of proceeds, overall sustainability goals and framework, and how the green bond fits into the firm’s financial strategy.

Resources: KPMG: Gearing Up For Green Bonds

RBC Capital Markets: Fifty Shades of Green Bonds